Are you willing to Rating good USDA Financing? Which Map Will tell you

If you are searching to own a far more rural and residential district life – where in fact the cost-of-living is normally straight down – a good USDA home loan could save you cash on https://paydayloancolorado.net/san-acacio/ the down commission and you will interest.

The capability to functions remotely has generated a new chance to alive everywhere need. Due to the fact COVID-19 limitations is actually more sluggish increased, more than a third away from professionals declaration proceeded to get results regarding family irrespective of the workplace beginning support.

There can be an individual matter – discover an excellent USDA home loan, you will want to look for an eligible property. And here the fresh new USDA home loan map is available in.

What is a good USDA Loan, and just how Do you really Get You to?

Mortgages throughout the You.S. Department away from Farming is actually money that will be meant to service low-money household to locate affordable housing beyond big places. This type of funds usually are a good idea for borrowers which won’t otherwise be eligible for a traditional financial.

The initial benefit of a great USDA loan is that it will not need an advance payment – that is certainly the greatest monetary burden to help you homeownership. The fresh new fund run getting 30-year terms in the repaired interest rates (some below conventional financing) and will be used to purchase manager-occupied, single-members of the family residential property and you may condos.

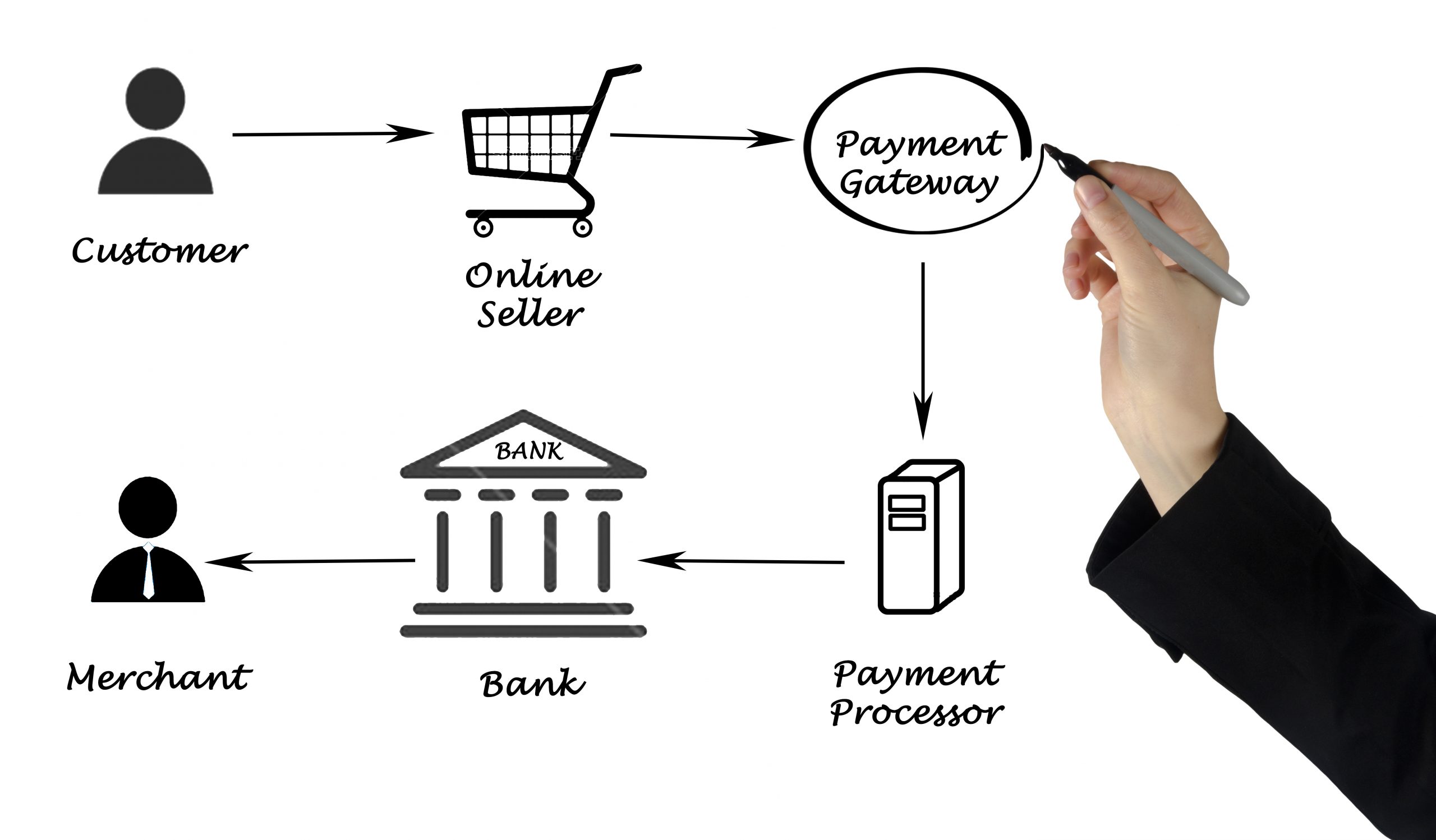

Brand new USDA loan application procedure starts with deciding their eligibility, which relies on your income, credit rating, and other debt. For folks who be considered, you can work with good USDA-approved lending company to help you secure a home loan pre-recognition and start finding USDA-recognized property.

Qualifications Requirements to own USDA Home loans

New regards to an effective USDA financing should be great, but they’re not for everyone. To ensure that you have a tendency to be eligible for you to definitely, you will have to meet up with the after the requirements:

- Your earnings must be within 115% of your average domestic earnings constraints specified for your town

- You really must be a beneficial U.S. Resident, You.S. non-resident national, or certified alien

- You will likely you desire a credit history regarding 640 or significantly more than

- Debt burden must not meet or exceed 41% of the pre-taxation money

- You must agree to individually invade the structure since your number one house

- It ought to be found within a qualified outlying urban area

- It should be one-family relations hold (with apartments, standard, and you will are created residential property)

- There is no acreage restriction, although property value the brand new home cannot meet or exceed 29% of one’s worth of the home

Professional Tip

One which just score dependent on your brand new possible family, check out the USDA interactive map to see if it’s eligible.

What Qualifies once the a beneficial Rural Urban area

Before you could love any style of home, you will need to discover which parts in the area qualify toward USDA system. How the USDA defines rural areas relies on your area.

Generally, these areas is defined as discover nation that’s not element of, regarding the one urban area, told you Ernesto Arzeno, a mortgage inventor with Western Bancshares.

Brand new principle are elements which have an inhabitants which have less than simply 10,one hundred thousand, Arzeno said, even if you to laws is easy and you will fast. For almost all areas, based homeownership pricing, the latest USDA allows populations doing thirty-five,100, but do not higher than one to. Together with designations get changes because USDA reviews her or him every long-time.

Strategies for the fresh new USDA Mortgage Map

The new USDA’s entertaining home loan map is the device one allows the thing is that if the a property is eligible. It works in two means: Searching actually toward address off property you might be given, and it will leave you an answer throughout the qualification. Or, you could potentially navigate inside the chart to determine what components generally are believed rural.

- Open the brand new USDA Home loan Chart here.

Visitors with this particular map isnt thus diverse from having fun with Bing Maps or any other similar equipment. But below are a few things to think about with all the USDA home loan map:

Try good USDA Financial Best for you?

USDA Home loans are going to be good pathway to help you homeownership, especially if you’re looking to live on outside of a giant city. But with people financing, you will find benefits and drawbacks. Some tips about what to adopt.

A monthly investment commission (similar to personal financial insurance policies) are added to the borrowed funds percentage. It can’t end up being terminated immediately following interacting with 20% security.

It’s important to stress the brand new financial downsides. Missing an advance payment form you will get a big loan add up to pay focus towards. And additionally, a monthly money percentage will get a complete duration of people USDA financing. With this, definitely believe all home loan money options to select and therefore may be the ideal fit for your.